In the modern banking landscape, financial institutions leverage advanced technology to streamline operations and enhance customer experience. Tallyman Axis Bank is a vital tool that helps Axis Bank efficiently manage customer accounts, recover outstanding payments, and maintain a structured approach to collections. This system plays a critical role in handling overdue accounts and ensuring the bank’s financial stability. If you are looking for details about Tallyman Axis, including its functionalities, login process, and benefits, this article will provide a detailed breakdown of everything you need to know about Axis Tallyman and how it contributes to Axis Bank’s collection and recovery processes.

What is Tallyman Axis Bank?

Tallyman is a debt collection management software that helps financial institutions like Axis Bank track overdue payments and recover outstanding debts efficiently. Axis Bank Tallyman integrates with banking systems to provide a streamlined approach for handling defaulters, structuring repayment plans, and sending reminders to customers.

This tool is primarily used by the bank’s collection teams to manage and monitor loan recoveries, credit card dues, and other outstanding balances. The system allows real-time updates on customer accounts and helps in reducing non-performing assets (NPAs), which are a significant concern for any bank.

Key Features of Tallyman Axis Bank

The Tallyman Axis system is equipped with several essential features that enhance the efficiency of Axis Bank’s collection processes. Here are the primary functionalities of the Axis Bank Tallyman system:

- Automated Collection Process

- The system automates the collection process, reducing manual efforts.

- It sends reminders via SMS, email, and calls to customers with outstanding dues.

- Real-time Account Monitoring

- Provides real-time updates on customer payments and overdue accounts.

- Helps collection teams track individual cases efficiently.

- Seamless Integration

- Integrates with Axis Bank’s core banking system for smooth data transfer.

- Reduces errors and improves data accuracy.

- Structured Repayment Plans

- Allows customers to restructure their repayment plans as per their financial situation.

- Provides flexible options for clearing outstanding dues.

- Compliance with Banking Regulations

- Ensures all debt collection activities follow regulatory guidelines.

- Protects the rights of customers while facilitating the recovery process.

- User-friendly Dashboard

- Offers an easy-to-use interface for collection agents and bank employees.

- Displays customer history, outstanding amounts, and follow-up schedules.

How to Access Tallyman Axis Login?

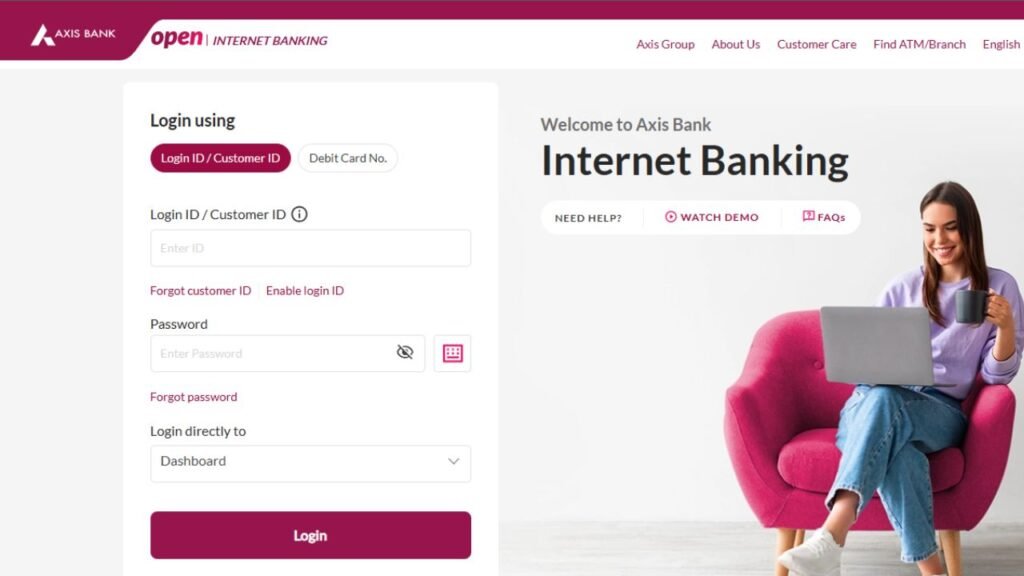

For Axis Bank employees and collection agents, accessing Tallyman Axis Login is essential to track and manage outstanding debts. Below is the step-by-step guide to logging into the Axis Tallyman system:

Step-by-Step Guide to Tallyman Axis Login:

- Visit the Official Login Portal

- Go to the official Axis Bank Tallyman login page. (The URL is usually provided by the bank’s IT department.)

- Enter Your Credentials

- Input your assigned Username and Password.

- Complete the Security Verification

- Some users may be required to enter an OTP sent to their registered mobile number for added security.

- Access the Dashboard

- Once logged in, you can view customer details, outstanding dues, and recovery progress.

Troubleshooting Tallyman Axis Login Issues

If you face issues while trying to access the Axis Tallyman system, consider the following solutions:

- Incorrect Credentials: Double-check your username and password.

- Forgot Password: Use the ‘Forgot Password’ option to reset your credentials.

- Browser Issues: Clear cookies/cache or try logging in from another browser.

- Server Downtime: If the system is down, wait for a while before trying again.

Benefits of Using Axis Bank Tallyman

For Axis Bank

- Enhances Debt Recovery Efficiency: Automates follow-ups and collections.

- Reduces NPAs: Helps in structuring repayment plans to minimize defaults.

- Improves Customer Relationship: Offers flexible repayment options for struggling customers.

- Ensures Compliance: Keeps all recovery processes aligned with legal regulations.

For Customers

- Structured Payment Solutions: Allows customers to repay dues in a structured manner.

- Convenient Notifications: Reminders via SMS, calls, and emails ensure timely payments.

- Transparent Process: Customers get real-time updates on their outstanding balance and payment history.

Comparison of Tallyman Axis Bank with Other Collection Systems

The following table provides a comparative analysis of Tallyman Axis Bank and other debt collection management systems:

| Feature | Tallyman Axis Bank | Other Collection Systems |

| Automated Collections | ✅ Yes | ⚠️ Limited |

| Real-time Monitoring | ✅ Yes | ❌ No |

| Integration with Core Banking | ✅ Yes | ⚠️ Partial |

| Structured Repayment Plans | ✅ Yes | ❌ No |

| Compliance with Regulations | ✅ Yes | ⚠️ Varies |

| User-friendly Dashboard | ✅ Yes | ⚠️ Complex |

How to Contact Axis Bank for Tallyman Axis-Related Queries?

If you need assistance with Tallyman Axis Bank, you can reach out to Axis Bank through the following channels:

- Customer Care: Call Axis Bank’s official customer service number.

- Bank Branch: Visit the nearest Axis Bank branch for in-person assistance.

- Official Website: Check the Axis Bank website for FAQ sections and support forms.

- Email Support: Send an email to the Axis Bank helpdesk for login or technical issues.

Conclusion

Tallyman Axis Bank is a robust collection management system that enables efficient debt recovery and helps maintain financial stability for both Axis Bank and its customers. The system offers multiple advantages, including automated collections, real-time monitoring, and structured repayment plans. With Tallyman Axis Login, Axis Bank employees can streamline recovery processes while ensuring compliance with banking regulations.

For customers, Axis Tallyman ensures a structured and transparent repayment process, minimizing financial stress. Whether you are a bank employee or a customer looking to understand Axis Bank Tallyman, this guide provides all the necessary insights to navigate the system effectively.

FAQs

Q1: What is the Tallyman Axis Bank system used for?’

A1: It is used for managing and recovering overdue payments efficiently by automating follow-ups and structuring repayment plans.

Q2: How do I log into Tallyman Axis Bank’s?

A2: Visit the official login portal, enter your credentials, complete security verification, and access your dashboard.

Q3: Can customers use Tallyman Axis Bank’s?

A3: No, it is primarily for Axis Bank employees and collection agents.

Q4: What should I do if I forget my Tallyman Axis login details?

A4: Use the ‘Forgot Password’ option or contact Axis Bank’s IT support for assistance.

Q5: Does Tallyman Axis Bank’s offer flexible repayment options?

A5: Yes, it provides structured repayment plans for customers to manage their outstanding balances.

Read Our More Blogs;-