Investing has changed a lot in 2025. Interest rates shifted, digital platforms grew, and investors started trusting AI-driven tools more. Among these, Gomyfinance.com Invest became a name many people noticed. To understand how it works, I invested $10,000 and tracked my progress over six months. Here is a complete and detailed breakdown of my experience.

Table of Contents

Why Did I Choose Gomyfinance.com Invest for My Test?

Before putting in real money, I looked at several platforms. Gomyfinance.com Invest stood out because of its simple design and wide options. The platform combined modern AI tools with traditional investments. That balance made it more attractive.

High Return Options That Caught My Eye

The platform offered a mix of stocks, ETFs, bonds, REITs, and even crypto. Unlike some services, trades had no commission charges, which meant I could keep more of my returns. Their AI-based system provided personalized advice, analyzing market conditions and suggesting allocations.

How Risk Tolerance Matched My Goals?

Before investing, I completed a detailed survey. The system suggested a portfolio split of 60% ETFs, 30% stocks, and 10% bonds. This matched my medium-risk preference. The live tracking tools helped me monitor changes without confusion.

How Was My Account Setup and Initial Deposit?

The next step was starting the account. I wanted to see how easy and safe the process was.

What Was the Signup Experience Like?

Creating my account on Gomyfinance.com Invest took less than 10 minutes. I added my details, picked my currency, and set investment goals. A quick questionnaire guided the platform to design a plan tailored for me.

How Secure Did the Platform Feel?

Security was a highlight. The platform used bank-level encryption and two-factor authentication. I also went through KYC verification by submitting government ID. While it took some extra time, it gave me confidence that my money was safe.

Which Funding Options Were Available?

Depositing my $10,000 was straightforward. The platform allowed transfers via bank wires, cards, e-wallets, and even cryptocurrencies. My funds reflected within a few hours, which showed efficiency.

| Deposit Method | Processing Time | Notes |

| Bank Wire | 1-2 days | Traditional but secure |

| Debit/Credit | Instant | Small fee applied |

| E-Wallets | Within hours | Easy for repeat funding |

| Crypto Deposit | Few minutes | Depends on blockchain speed |

Was the Dashboard Easy to Use?

At first glance, the dashboard felt packed with tools. Features like portfolio tracking, risk metrics, and automated recommendations seemed complex. But after exploring their video tutorials and FAQs, the setup became clear. Customer support also replied quickly when I had doubts.

What Investment Options Were Available?

Gomyfinance.com Invest focused on giving investors choices across multiple markets.

1. Stock Market and ETF Opportunities:- The platform allowed trading in U.S. stocks and a variety of ETFs. The ETFs covered industries, regions, and themes, giving me plenty of diversification. For someone who wants both passive and active investing, this was useful.

2. Bonds and Fixed-Income Products:- Government and corporate bonds were available too. They provided steady yields with clear risk labels, which made them beginner-friendly. For stability in my portfolio, this section worked well.

3. Crypto and Digital Assets:- Another highlight was regulated cryptocurrency access. Instead of using a separate crypto exchange, I could hold assets directly within my account. This made it safer and easier.

4. Real Estate Through REITs:- REITs gave me exposure to property without direct ownership. Their analytics showed performance and expected returns, which helped me choose wisely.

5. Premium Investor Benefits:- Premium users could access emerging markets, advanced dashboards, and one-on-one advisor calls. While it cost extra, the added tools seemed valuable for larger portfolios.

What Strategy Did I Follow During Six Months?

After funding my account, I built a strategy that balanced growth with safety.

My Portfolio Split

I followed the platform’s suggested allocation:

- 40% stocks and ETFs for growth

- 30% bonds for stability

- 20% REITs for real estate exposure

- 10% cryptocurrency for high-risk opportunities

This spread helped me avoid depending on one single asset.

How Did the Automated Tools Help?

The platform’s rebalancing feature automatically adjusted my portfolio when market changes occurred. I also set recurring investments, which grew my account steadily.

How Did I Adjust During Market Changes?

The AI system gave me alerts when trends shifted. For example, when global markets dipped, I was advised to shift some funds into bonds. This flexibility made the system valuable.

What were the Costs?

The fee structure was transparent. There were no commissions on trades. Automated portfolios carried small management fees. Premium services had subscription pricing, but they added useful tools for serious investors.

How Did My $10,000 Perform After Six Months?

The most important part of my test was the actual performance of my $10,000 over six months. The results gave me a clear picture of how Gomyfinance.com Invest manages money across different asset classes. In the first three months, my portfolio showed a 4.14% growth. This early growth came largely from my allocation in ETFs and U.S. equities. By the second quarter, my portfolio improved further because of a balanced mix of bonds and international funds, which added both stability and extra gains.

When I compared my results with broader market benchmarks, the difference was noticeable. The S&P 500 returned only 1.44% in the same period, while my diversified portfolio on Gomyfinance.com Invest delivered 4.22% growth. This performance gap highlighted the value of diversification and the support of AI-driven rebalancing tools.

Which Investments Performed the Best and How Did Returns Look After Fees?

Breaking down performance by category made things even clearer. Large-cap U.S. stocks returned around 6%, driven mainly by technology and consumer sectors. International funds did better with 7.1% growth, thanks to strong developed markets. Bonds played their role well, with a steady 4.9% return, and helped reduce risk during volatile weeks.

Real Estate Investment Trusts (REITs) gave me 5.5% growth, balancing income and diversification. Crypto was the most unpredictable but still managed a 9% return, which made sense since I limited it to just 10% of my portfolio.

After deducting fees, my annualized return settled at 7.6%. The reporting system showed returns clearly, breaking down profits by asset type and highlighting how much came from dividends, capital appreciation, and rebalancing gains.

Here’s a simplified table that shows how each asset type performed:

| Asset Type | Return Rate | Notes |

| U.S. Stocks | 6% | Growth mainly from tech sector |

| International | 7.1% | Boosted by strong developed markets |

| Bonds | 4.9% | Steady, inflation-beating returns |

| REITs | 5.5% | Balanced exposure to property sector |

| Crypto | 9% (volatile) | High risk but strong short-term gain |

Final Thoughts:

My six-month journey with Gomyfinance.com Invest proved that digital platforms can outperform traditional markets. The combination of AI-driven insights, diverse assets, and strong security made the experience rewarding. While premium features may cost extra, the returns and convenience justify the platform. For both new and experienced investors, this service provides a balance between automation and control. My $10,000 grew at a steady pace, and I would recommend exploring it if you want a structured way to invest in 2025.

FAQs

Q1. What can I invest in with Gomyfinance.com Invest?

Ans. You can choose from stocks, ETFs, bonds, crypto, and REITs. Premium users get access to emerging markets.

Q2. How do returns compare to the market?

Ans. My portfolio grew by 4.22% in one quarter, while the S&P 500 grew just 1.44%.

Q3. What are the fees?

Ans. No commissions are charged. Management fees for portfolios are low. Premium features use subscription pricing.

Q4. How does AI improve the experience?

Ans. AI helps by rebalancing portfolios, suggesting smart allocations, and analyzing live trends.

Q5. Is the platform suitable for beginners?

Ans. Yes, it works for both new and advanced investors. Beginners benefit from automation, while advanced users enjoy deeper analytics.

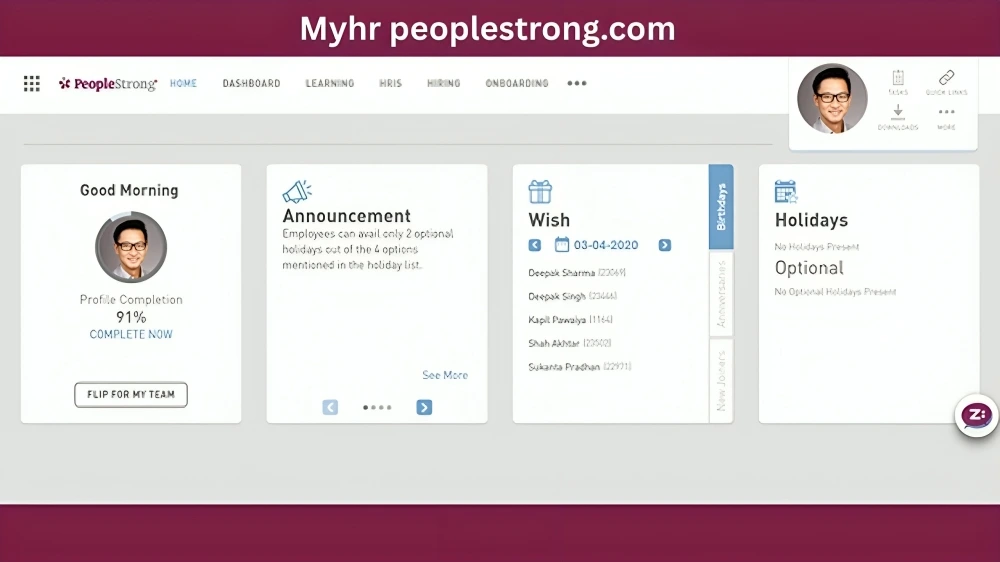

Read Our More Blogs:- myhr peoplestrong.com – The Smarter HR Solution for Businesses